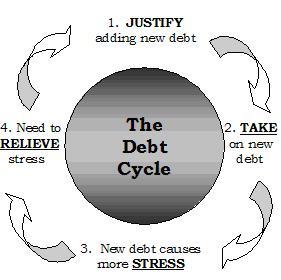

Being caught in a debt cycle can be a costly and miserable experience, but with a few clever money management tips you can easily break your way out. Working your way out of a major debt is extremely rewarding as it allows you to get back on track with a disciplined saving regime and monthly budget.

It’s vitally important that you prepare a savings plan best suited to your personal financial needs, as once you’ve gotten out of debt, it’s often easy to fall back into the same situation again.

Changing your spending habits, lifestyle and mindset all go a long way to ensuring you stay debt free in the long term. By following and sticking to a few simple steps, you will be able to stay out of the debt cycle for good.

The first step to financial security is to create a family budget and no matter what, stick to it. Don’t think of your budget as a way to stop you spending, instead your budget should be a financial plan aimed at tracking your long term goals.

There is no need to make things complicated, your budget should be as simple and as straight forward as possible. Today there is plenty of smartphone apps out there to help you with your budgeting, but if you prefer the more old school approach, a simple pen and paper will work just as well.

Tracking your spending on a daily basis allows you to record receipts and helps you to make a note of when, where and how much you spent. This will allow you to see where your hard earned money is going each month and will ensure that you develop healthy spending habits.

Another clever tip to help you avoid being caught in a debt cycle is to shop with your debit card as much as possible, rather than using your credit card. Only if you are able to pay off your credit card balance in full each month and avoid any interest payments, would make this a good shopping method.

The problem in general with credit cards is that once you miss a credit card payment, interest will be charged on the un-paid balance and these days’ average interest rates can be as high as 25%.

Using your debit card to make your purchases allows you to avoid any excessive interest repayments and ensures that each month there will be no nasty credit card bill surprises.

If you prefer to spend cash rather than using a debit card, always ensure that you carry only the budgeted amount of money with you. This will make sure that you avoid any unnecessary splurges and that you stick to your allocated shopping amount.

The final item which should be mandatory in your monthly budget is “savings”. This needs to be a permanent fixed expense in your monthly budget and it’s best if this is automatically debited each month from your bank account.

Saving around 10% of your weekly pay check and putting it into a separate bank account is a good habit to get into. You can think of this account as your emergency fund growing each month and available at a moment’s notice should you need it.

By following these above tips, you will be able to avoid being caught in a nasty debt cycle and live a more enjoyable life with your loved ones.